Payment facilitators and gateways are two important tools that merchants can use to facilitate online payments. Payment facilitators help merchants to process payments from their customers, while payment gateways provide a secure connection between the merchant and the payment processor. Together, these tools can help merchants to improve their payment processing efficiency, reduce costs, and provide a better user experience for their customers.

Merchant provider vs payment facilitator

When it comes to payment processing, businesses often have two options: working with a merchant provider or a payment facilitator. A merchant provider acts as an intermediary between the business and the payment networks, enabling the business to accept various payment methods. They typically require the business to have their own merchant account and undergo a more rigorous underwriting process. On the other hand, a payment facilitator, also known as a payment aggregator or a “payfac,” simplifies the payment process by offering a unified, streamlined solution. They handle all the merchant accounts on behalf of the businesses they serve, eliminating the need for individual underwriting. While a merchant provider offers more control and customization options, a payment facilitator offers simplicity and speed, making it an attractive choice for small businesses or startups looking to quickly start accepting payments.

Automating the payment processing process

Payment facilitators and gateways can also help merchants to save time and reduce costs. By automating the payment processing process, payment facilitators and gateways can help merchants to free up valuable resources that can be used to focus on other aspects of their business. This can help merchants to improve their overall efficiency and productivity, while also reducing their operational costs.

Better user experience

Another important benefit of using a payment facilitator and gateway is that they can help merchants to provide a better user experience for their customers. By providing a secure and reliable way for customers to make payments, payment facilitators and gateways can help merchants to build trust and confidence with their customers. This, in turn, can help merchants to improve their customer satisfaction and retention, leading to increased sales and revenue.

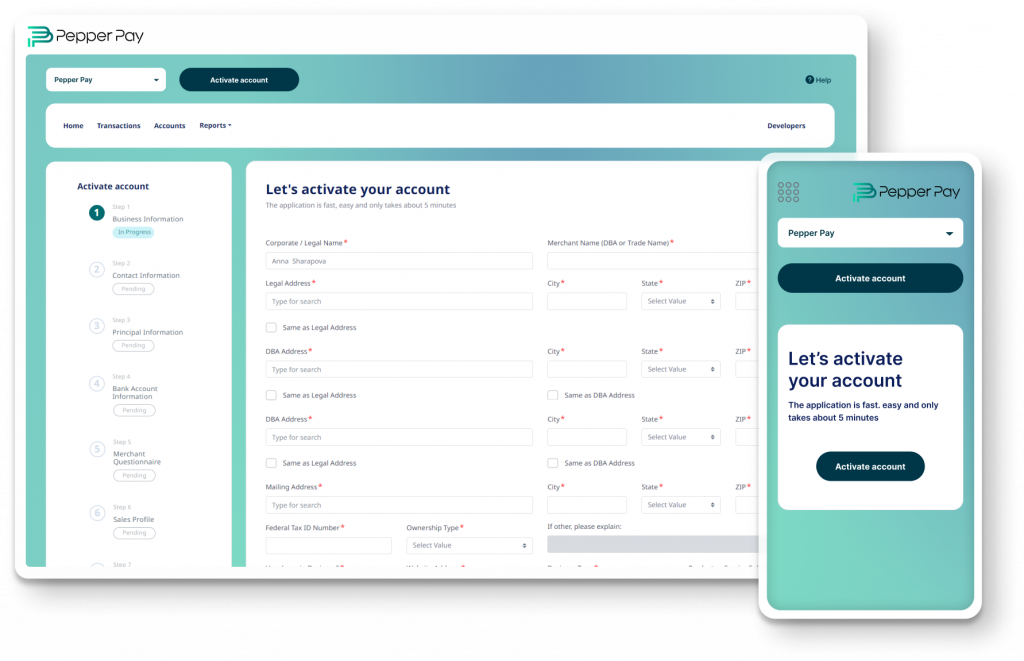

Integrating Pepper Pay gateway into eCommerce website

Pepper Pay has a payment gateway that provides merchants with a simple, secure, and reliable way to accept payments from their customers. One of the key advantages of using the Pepper Pay gateway is the ease with which it can be integrated into various eCommerce websites, making it a popular choice among merchants who are looking for a hassle-free payment processing solution.

Once Pepper Pay has been integrated into an eCommerce website, merchants can start accepting payments from their customers right away. Customers can choose from a variety of payment options, including all credit and debit cards.

One of the main benefits of using Pepper Pay for eCommerce payments is the streamlined checkout experience that it provides for customers. Pepper Pay also offers a range of features and tools that can help merchants manage their payments more effectively. These include transaction monitoring, detailed transaction reports, and advanced fraud detection and prevention tools.

To Sum Up

In conclusion, payment facilitators and gateways are essential tools for merchants who want to stay competitive in the eCommerce space. By using these tools, merchants can improve their payment processing efficiency, reduce costs, and provide a better user experience for their customers.

Pepper Pay has one such payment gateway that offers a range of features and tools to help merchants improve their payment processing efficiency and reduce their risk of fraud and chargebacks.