The world is moving towards a cashless future of payments. Cash is slowly losing its grip on the global financial system, with more and more people adopting digital payment methods. The growth of digital payments is driven by technological advancements that are making transactions faster, cheaper, and more secure. The impact of this shift on businesses cannot be overstated. In this article, we will explore the cashless future of payments and its impact on businesses.

Advantages of the cashless payments

The cashless future of payments has several advantages for businesses. Firstly, it makes transactions faster and more convenient. Digital payments can be completed in seconds, compared to traditional methods like checks and cash, which can take several days to clear. Faster transactions mean businesses can complete more transactions in less time, increasing revenue and productivity.

Secondly, digital payments are more secure than traditional methods. Cash can be lost or stolen, while checks can be forged. Digital payments are protected by encryption and other security measures that make it harder for fraudsters to steal funds. This reduces the risk of fraud and improves the safety of transactions.

Thirdly, digital payments are cheaper than traditional methods. Traditional payment methods like checks and cash require businesses to hire additional staff to handle the transactions. Digital payments, on the other hand, can be automated, reducing the need for additional staff. This results in cost savings for businesses, which can be invested back into the business to drive growth.

Finally, the cashless future of payments has the potential to open up new markets for businesses. Digital payments enable businesses to sell their products and services to customers who are located anywhere in the world. This means businesses can expand their customer base and increase revenue.

Let’s talk about challenges

However, the shift towards a cashless future of payments is not without its challenges. One of the biggest challenges is the need for businesses to adopt new technologies and upgrade their systems to accommodate digital payments. This can be expensive and time-consuming, and not all businesses may have the resources to do so.

Another challenge is the potential for cybersecurity risks. Digital payments are vulnerable to cyber-attacks, which can result in loss of funds and sensitive customer information. Businesses must implement robust security measures to protect themselves and their customers from these risks.

Despite these challenges, the benefits of a cashless future of payments far outweigh the challenges. Businesses that embrace digital payments will be well-positioned to thrive in the future.

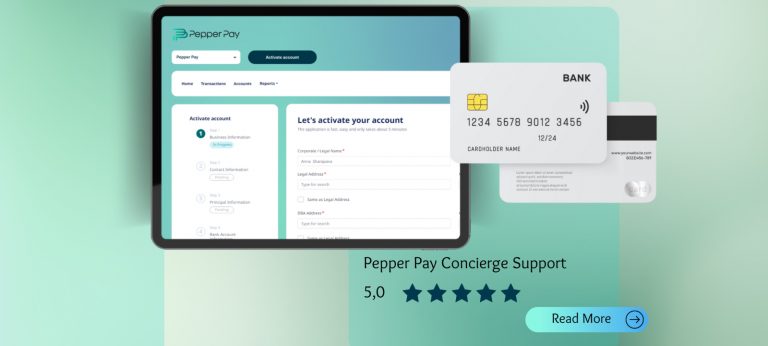

Pepper Pay is a payment facilitator that can help businesses make the transition to digital payments. Pepper Pay offers a range of payment solutions that are fast, secure, and affordable. Our solutions are designed to help businesses of all sizes and types to improve their payment processes and drive growth. With Pepper Pay, businesses can enjoy the benefits of a cashless future of payments without having to invest in expensive technology or hire additional staff. If you are a business owner looking to make the transition to digital payments, Pepper Pay is an excellent choice.