Introduction: Why Dual Pricing Is Gaining Traction

As small businesses face rising costs from inflation, processing fees, and volatile tariffs, finding ways to protect your margins is more important than ever. Card processing fees alone can eat into 2.5–3.5% of your revenue—every single month.

That’s why more small business owners are turning to dual pricing—a simple, transparent pricing model that helps eliminate card processing fees without breaking any rules or confusing your customers.

In this post, we’ll explore what dual pricing is, why it’s legal, and how it helps small businesses thrive in 2025.

What Is Dual Pricing?

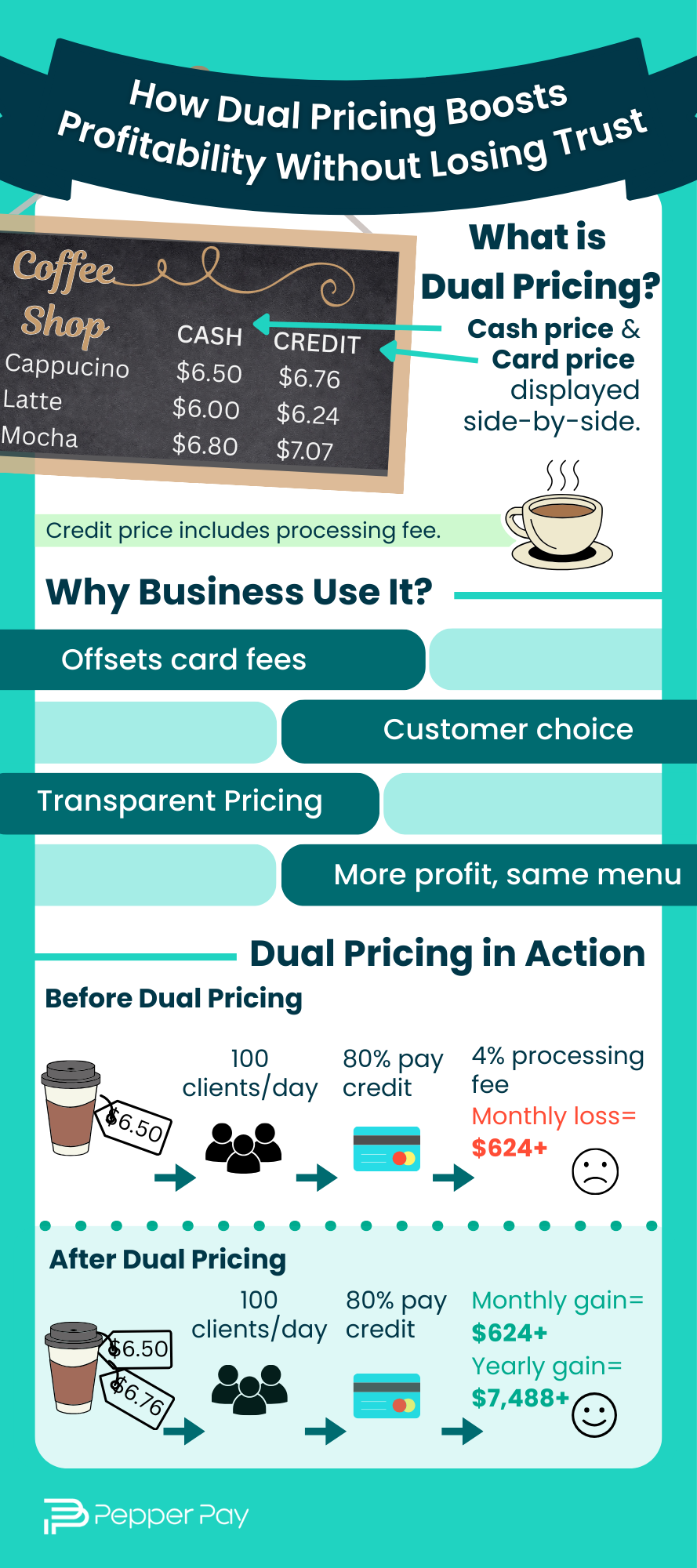

Dual pricing means displaying two clearly marked prices:

- One for cash payments

- One for credit/debit card payments

The card price includes the cost of processing, so you’re no longer losing a cut of each sale. Customers can choose how they pay—no tricks, no hidden fees.

Unlike surcharging (which is banned or limited in some states), dual pricing is legal in all 50 states when clearly disclosed.

Why Dual Pricing Matters More Than Ever

- Processing Fees Are Rising: Digital transactions are up, and so are costs. Passing them on is fair and transparent.

- Tariffs Are Unpredictable: Import prices and wholesale costs fluctuate with shifting policies. Dual pricing helps protect your bottom line.

- Consumers Expect Choice: Today’s customers appreciate transparency—and many will gladly pay a few cents more to use their card.

- 100% Legal When Done Right: Dual pricing is protected under federal regulations when implemented with clear signage and compliant POS systems.

Benefits of Dual Pricing for Small Businesses

Cost Savings: Keep more of what you earn by passing card fees to card users.

Price Transparency: Builds customer trust—no surprise charges at checkout.

Higher Margins: Increase monthly revenue without raising your base prices.

Competitive Advantage: Advertise your cash price without taking a hit on card sales.

Simplified Accounting: With fees offset, your net sales reporting is cleaner and more accurate.

The Business Impact: A Real-World Example

Let’s say you run a neighborhood café doing $30,000/month in card sales.

At an average 3% fee, you’re losing $900/month to card processing fees.

With dual pricing, you could pass that cost back to customers who choose cards—while keeping your cash price the same and maintaining a competitive edge.

That’s $10,800/year back in your pocket.

Pepper Pay Makes Dual Pricing Easy

At Pepper Pay, we help you set up dual pricing legally, clearly, and without confusion.

We provide:

- POS systems with dual pricing built in

- Legally compliant signage and receipt formatting

- Support from onboarding through growth

- Next-day funding and competitive merchant tools

Whether you’re running a restaurant, retail shop, or salon—we’ve got your back.

Conclusion: This Isn’t a Loophole—It’s Smart Business

In 2025, small business owners have enough surprises to manage—from inflation to tariffs to customer churn. Dual pricing is a practical, legal way to take back control of your margins—and your peace of mind.

Want to see how it could work for your business?

Get in touch with us today!